The latest twist exploits perpetual futures platforms with deep liquidity and lax KYC, effectively turning ill-gotten funds into legitimate-looking trading profits. This has gotten easier as the trading depths on perps exchanges has grown significantly over the last year. Let’s take a look at exactly how it’s done:

High-Leverage Alchemy

The core concept is to use extreme leverage on a no-questions-asked futures exchange to deliberately liquidate “dirty” funds, while profiting from an opposite position taken with clean money elsewhere. On these perps platforms, you have exposure to no expiry futures often offering 50x, 100x or higher leverage. At 50x leverage, a price move of just ~2% can wipe out a position entirely, along with the collateral margin supporting it.

This volatile dynamic becomes a tool for laundering.

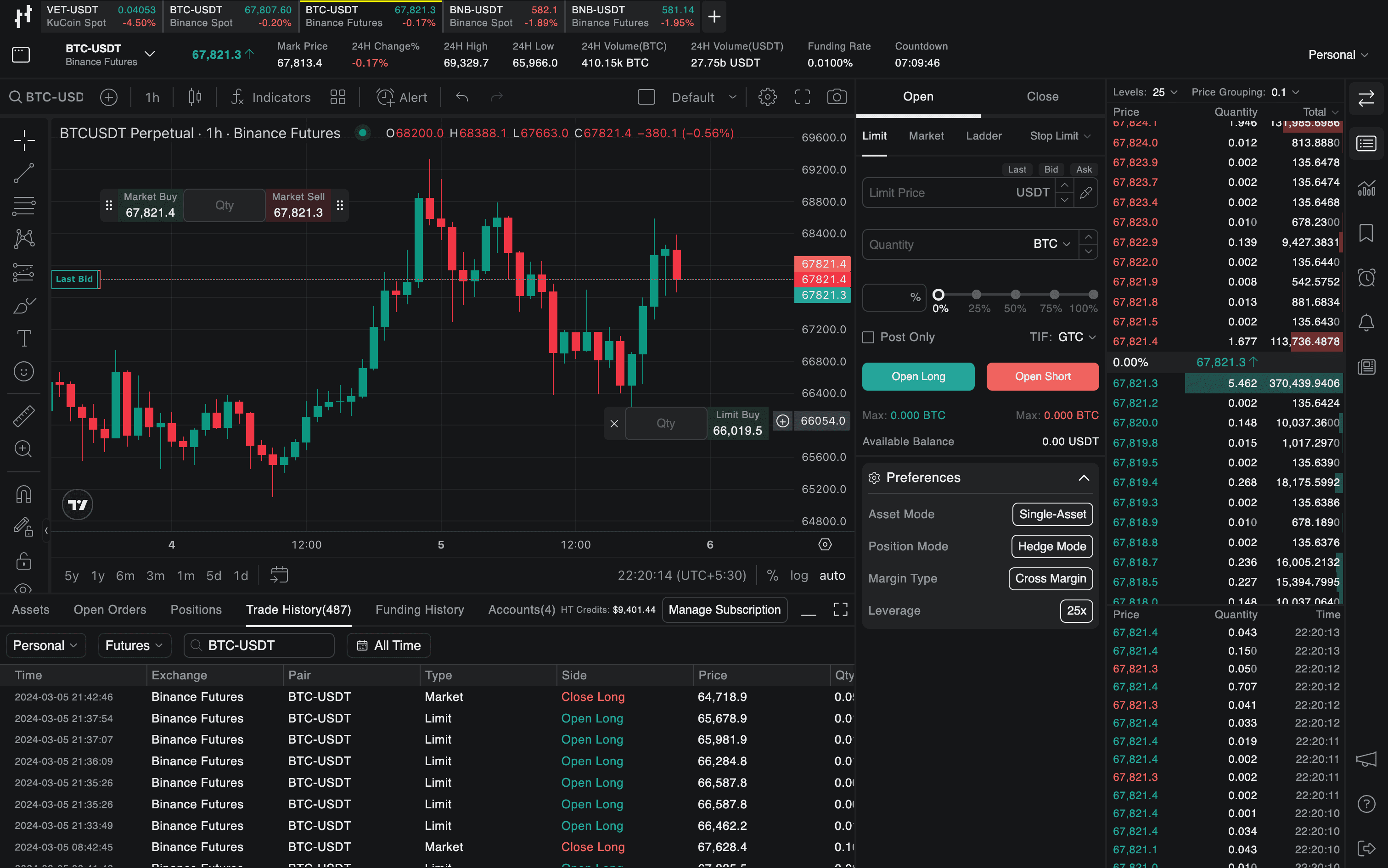

Consider a simplified scenario observed on platforms like Hyperliquid (which requires no KYC as it’s a DEX protocol):

- Deposit Stolen Crypto: The bad actor deposits, say, $5 million in stolen crypto into an exchange account. This account is funded by traceable “black” funds from a hack or other illicit source.

- Max-Leverage Bet: Using 50x leverage, they open a $250 million short position on a cryptocurrency. (In other words, the $5M collateral backs a massive bet against the asset’s price.)

- Hedge Elsewhere with Clean Money: Simultaneously, they open an equal $250M long position on the same asset at a different exchange, using clean funds in that account. This could be a compliant exchange or another platform where the money’s origin isn’t flagged. Now the two positions offset each other in terms of market risk.

- Force a Liquidation: A small price move (~2%) in favor of the long is enough to trigger a full liquidation of the 50x short on the first exchange. When the short position blows up, the $5M in stolen collateral is lost.

- “Clean” Profit Emerges: Meanwhile, that same 2% price move yields about $5M profit on the long position, which the actor can close out—now effectively “washing” the original stolen funds into legitimate profit.

In essence, the criminal intentionally sacrifices the tainted money on one side and collects it back on the other side, minus some fees and slippage. Thanks to high leverage, even a tiny market movement can transfer the entire value. 2% is nothing in terms of volatility for $BTC. This wipes the blockchain trail of the stolen funds, converting it into profit that appears to be the outcome of savvy trading.