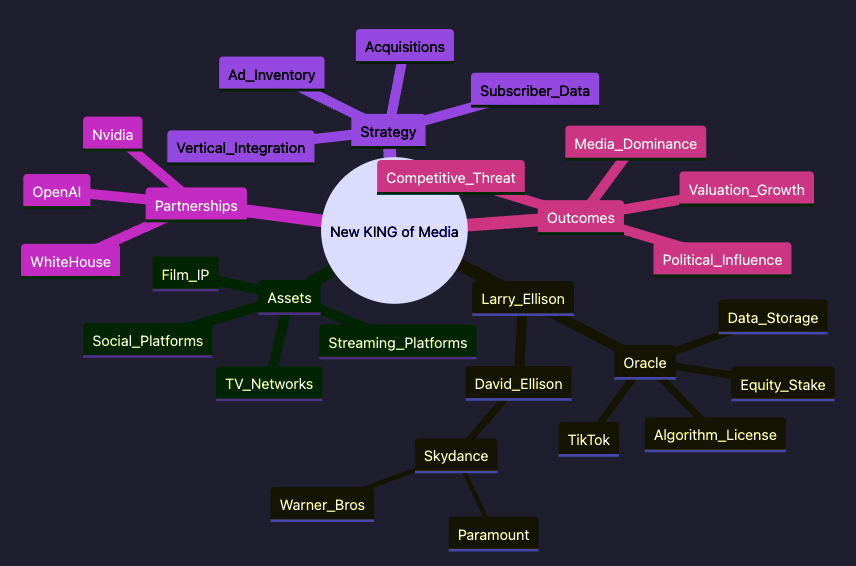

Patrick Bet-David argues that Larry Ellison (and his son David Ellison via Skydance) is quietly assembling one of the most powerful media empires. Through a chain of high-profile deals, Skydance’s acquisition of Paramount and its pursuit of Warner Bros., plus Oracle’s role buying 80% of TikTok’s U.S. operations, the Ellison family could combine IP, networks, streaming, and social data into a unique, vertically integrated media powerhouse. Bet-David compares the potential combined revenue to Disney and Netflix, highlights Oracle’s technical role (data storage, algorithm oversight, equity stake), emphasizes strategic partnerships (Nvidia, OpenAI), and warns this consolidation will yield massive market and political influence.

Patrick Bet-David argues that Larry Ellison (and his son David Ellison via Skydance) is quietly assembling one of the most powerful media empires. Through a chain of high-profile deals, Skydance’s acquisition of Paramount and its pursuit of Warner Bros., plus Oracle’s role buying 80% of TikTok’s U.S. operations, the Ellison family could combine IP, networks, streaming, and social data into a unique, vertically integrated media powerhouse. Bet-David compares the potential combined revenue to Disney and Netflix, highlights Oracle’s technical role (data storage, algorithm oversight, equity stake), emphasizes strategic partnerships (Nvidia, OpenAI), and warns this consolidation will yield massive market and political influence.

Key Takeaways

- Skydance (led by David Ellison) bought Paramount for $8B and is pursuing Warner Bros., rapidly scaling from a small studio to a major media owner.

- Oracle (Larry Ellison, 41% owner) is acquiring 80% of TikTok’s U.S. business; Bytedance retains 20% as a minority.

- Oracle’s responsibilities in the TikTok deal: host U.S. user data, oversee the recommendation algorithm under license, and hold a significant equity stake in the new JV.

- Combined assets (Skydance + Paramount + TimeWarner + TikTok) could produce ~$93B in revenue, roughly matching Disney and twice Netflix in the presenter’s estimate.

- This combination creates a rare flywheel: premium film/TV IP + distribution networks + streaming + one of the largest social platforms and first-party user data.

- Owning ad inventory across entertainment networks and TikTok amplifies advertising monetization potential and cross-promotion opportunities.

- Data advantage: centralized subscriber and user behavior data can improve targeting, content decisions, and algorithmic recommendations.

- Strategic partnerships (Oracle ⇄ Nvidia ⇄ OpenAI) could accelerate technical and AI capabilities for media personalization and infrastructure.

- The TikTok purchase price (~$14B cited) is framed as a deep discount compared to social-platform valuations (Facebook/Meta market cap referenced as $1.8T), implying high upside.

- Political influence: consolidated media+data assets amplify access and leverage with policymakers and presidential candidates.

- Succession and family dynamics: David Ellison’s rising role, plus Larry’s net worth and age (81 in the talk), imply a long-term transfer of influence and wealth.

- Competitive landscape: Few (if any) competitors control both blockbuster IP catalogs and a dominant social platform with global virality.

- Risks: regulatory/antitrust scrutiny, national-security optics (TikTok sale was politically driven), reputational/backlash risks, integration challenges.

- Governance questions: cross-ownership between Oracle (tech/data) and Skydance (content) raises concerns about editorial independence and algorithmic control.

- Financial implication: media valuations and revenue synergies could push family wealth dramatically higher; presenter speculates extreme future net worth increases.

- Execution hurdles: pending approvals, financing for large acquisitions, and operational integration across studios, networks, and a social platform.

- Advertising and subscription strategies: potential to bundle content, tie streaming subscriber data to ad products, and optimize retention via social engagement.

- Global vs. U.S. scope: Oracle’s role centers on U.S. TikTok operations and U.S. user data; global regulatory and operational complexity remains.

- Minority stake by Bytedance (20%) leaves technical and international coordination dynamics that matter to long-term control.

- Timing: many deals are in motion or proposed; Bet-David expects approvals and little effective resistance based on current relationships.